Energy Security Intelligence Research

ESIR

ESG STRATEGY RISK and COMPLIANCE PLANNING AGENDA 2050

Research and Publications

ESIR Research and Publications is always looking to the future in a competitive energy marketplace. However, going against the flow is our strategy; whereby traders are frequently buying oil and gas from well-established integrated oil majors who are finding growth much harder to achieve in a tough environment, where new sources of supply are either technically challenging or difficult to breakeven with high production margin. Why? because of political factors, struggle for market share or increasing resource nationalism. In contrast to the strategy of demergers and divestments to create more "pure play" businesses in an effort to maximise shareholder value are resulting to hoarding and storage of contango.

Therefore, purchase and download our quarterly and annual reports to execute dealing with uncertainty as your strategy. The strategy of all the IOCs has been to focus on materials upstream investments to provide future sources of growth. This has resulted in major divestment programmes, to include refineries, logistics assets and marketing businesses. While physical trading will always remain at the heart of the oil and gas industry, we have been able to take advantage of selective research and publications to add to your investment portfolios and continue to evaluate a number of future opportunity for your company.

New Global Players in Energy and Natural Resources Exploitation and Production

Increasing, trading companies have to compete for assets with resource-hungry emerging nations. As these emerging nations seek to secure supplies of essential fuel stocks, they are looking globally, pursuing technological innovations as well as reserves. In shale gas for example, analysis estimate Asian reserves to be larger than those in the Americas. According to the US Energy Information Administration (EIA), China Holds 19% of global resources and, significantly, it held its first shale gas licensing round in 2014.

The Chinese are as active in oil and gas as in other natural resources. The IEA was quoted in February 2015 saying that, for the first time, China is poised to become and oil producer to rival OPEC members with 4.8 million barrels per day, such as the United Arab Emirates and Kuwait.

Groups including PetroChina, Sinopic, Sinochem, and China National Overseas Oil Company (CNOOC), have a mandate to expand overseas and the means to do so. State-owned oil companies spent a record USD 45 billion buying foreign rivals in 2012-2015.

Sinopec is actively looking for opportunities and is starting to focus on developed markets and ambitious deals. For example, in January 2012, Sinopec unveiled a USD2.5 billion deal with Devon Energy to invest in five shale oil and gas fields from Ohio to Alabama. More recently, in February 2013 Sinopec announced that it will buy half of Chesapeake Energy's Mississippi Lime Oil and gas properties in Oklahoma for USD 1.02 billion.

Sinopec has also been active in Brazil. At the end of 2015, it acquired 40% of Repsol's Brazilian assets-planting its flag firmly in the South America market. While the Chinese producer already has a joint venture with Petrobras, the deal gives it a share of the offshore pre-salt reserves that are making Brazil the "new emerging energy superpower" in the oil world. It is likely that Repsol will seek to leverage this relationship for further co-operation in Argentina and Venezuela.

In July 2012, CNOOC bid USD 15.1 billion for Canada's Nexen. A previous multi-billion dollar bid for Unocal by CNOOC met with vehement political attacks from Washington, which eventually resulted in the Chinese company dropping the bid. As a result most Chinese energy companies had appeared to shy away from making large acquisition of listed companies overseas, preferring to take minority stakes in companies without taking an operating role. But Africa and the Middle-East becomes the next target.

"However China's development has, for some time, been driving a long-term shift in economic and political power away from west to east, marking the end of US post-WWII dominance. Its appetite for commodities, driven by surging urbanisation rates, helped to sustain prices during the financial crisis--however, China is slowing down in economic growth, and questions remain over what role Chinese demand for oil and gas will play in the future"

|

Nigeria Dilemma and Niger Delta Oil and Gas Industry

|

Entering New Markets and Dealing with Uncertainty in Oil and Gas Industry

|

| Understanding Doing Business in Canada's Oil and Gas Sector | Russia Outlook in Oil and Gas Sectors in the Era of Sanctions: Strategies for Foreign Investors |

Storage of Oil Special Report 2017

Trading in oil and gas/LNG in a volatile market is a high risk for energy investors. Since oil prices have found a floor of about $50 a barrel is still short of a major geopolitical shock, a price surge is not on its way, except you have excess storage facility to mitigate against price volatility. To gain a real sustainable trading platform, every energy company need a storage of some kind waiting for a price surge to absorbed a price shock.

Even when some insiders were calling for real and deep cuts to supply, storage is the only weapon to avoid shock and awe. Without adequate storage as a trader, between now and then bearish momentum could build as refineries enter maintenance, US inventory holders liquidate to avoid end-year taxes on shocks, and macro-economic worries is already resurfacing, not least the US Federal Reserve’s impending interest-rate rise or a new banking crisis loaming. It’s estimated that global oil-demand growth is weakening-the most recent International Energy Agency assessment for Q1 2017 saw a rise of just 0.8m b/d.

Moreover, when managing supply and hedging around a 200,000-barrel-a-day, refinery which had crude storage of close to 2m barrels; or a company that rarely kept storage completely full but the contango was too large to have empty space, and so a plan can be created to secure a long-term rateable supply of crude. As soon as company build adequate storage, it can be confident enough of securing the supply. A company can buy front-month futures contracts and sold those it had down the curve to lock in the contango. That will enable them to lower the cost of their inventory every month.

For example, if a cargo is priced to determine the flat price for payment, this type of structure is referred to as a physical published price index when the cargo was five days out of port on a three-day average. But when the three-day pricing arrived, it must sell for about 200 front-month crude futures contracts on each of the three days for a total of 600 contracts. This would cancel out the original long position they had and to begin to realise a contango profit. For instance, if crude contango more than $1.50 per barrel monthly, this will enable trading to increase refining margins each month. Thanks to the storage capability, this put them at a competitive advantage to those that didn't, all while generating excess returns.

The bottom line is that: how much cost reduction is sustainable without adequate storage facility? While technology and drilling improvements have clearly helped; companies are now getting much oil output for each dollar spent. Drillers are now able to sink multiple wells from a single location, which helps cut costs and time. The wells themselves are also better engineered now than they were a couple of years ago. They’re drilled longer, which helps tap into more of the shale seam with each well. Companies are also pumping more and more sand and proppant into the wells, which unleashes more of oil and gas when the well starts producing, meaning operators recover their costs quicker and, they hope, ultimately recover more from each well. These sorts of engineering and technical advances will continue to deliver benefits no matter what the oil price. But to reap these benefits and cut cost is the ability of companies to create adequate storage facility to mitigate against price volatility.

In this report, ESIR examines strategies when managing supply and hedging around oil storage. This report is based in part on ESIR's integrated approach to risk governance and security deficits, and in parts on the insights that will mitigate against price volatility in the oil and gas trading for company's operations. This 25 pages report includes the following strategies:

- Capacity available

- Tanks, gluts, contangos and markets fundamentals

- The search for storage

- China's strategic petroleum reserves (SPR): cheap oil

- Chasing Demand-Buyer's market

- Alternative storage system-working on the railroad

- Consulting and advisory for investors, and

- Appendix

We hoped that this report and perspectives it offers will add to your business insight.

More boom and bust for oil

The latest oil-market narrative holds that in late 2014 OPEC embarked on a new strategy that prioritised market share over high (and stable) oil prices, based on the view that high-cost and capital intensive US shale would be forced to swing under a glutted market. Instead, shale persevered, inventories swelled, and crude prices crashed, prompting OPEC to resume the mantle of supply manager late last year (2016). This narrative, and Saudi Arabia's newfound willingness to manage markets, underpins prevailing forecasts showing stable prices around $60 per barrel for the foreseeable future.

But my view, informed partly by historical research undertaken for my recently published book, Crude Volatility: The History and the Future of Boom-Bust Oil Prices, suggests a different narrative: OPEC went AWOL 10 years ago when it proved unable to cap the price boom, not two years ago when it declined to prevent a price bust. Notwithstanding recent pledges by some OPEC and Non-OPEC producers to restrain production, it is far from obvious the market has an effective swing producer or that future oil prices will be stable.

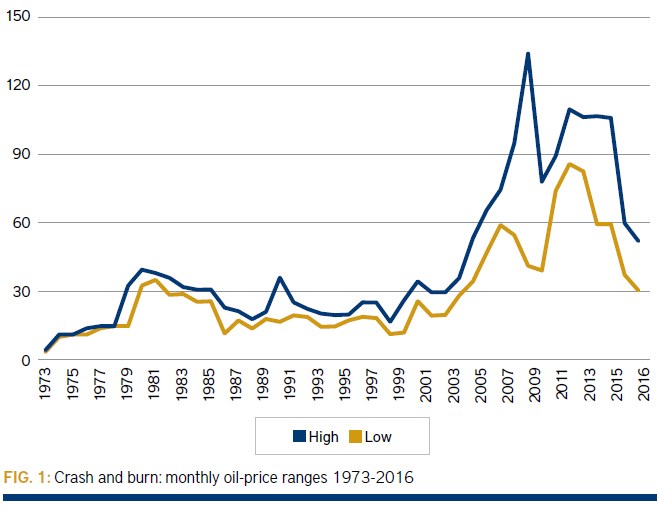

The extreme gyrations seen over the past decade—with prices tripling between 2004 and 2007, crashing in 2008, recovering and crashing again (by nearly 80% from the mid-2014 peak to the early 2016 trough)—are not examples of conventional oil-price volatility. The usual suspects were conspicuously absent: no embargo, war, or other disruptions caused the boom, and no recession caused the latest bust. This strain of volatility was last seen over 90 years ago and reveals something we've forgotten—how volatile oil prices can be when a structurally unbalanced market needs a swing producer but does not have one.

"The industry's history suggests that OPEC’s latest efforts to stabilise the oil price will not be successful"

Since oil's first days in western Pennsylvania 158 years ago, boom-bust price cycles have vexed the industry. To stabilise prices, companies tried with varying degrees of success to limit wellhead supply. John D Rockefeller's Standard Oil went first, exerting indirect control by monopolising the refining sector from about 1880 to 1911. Standard Oil's break up was followed by two turbulent decades of boom-bust prices until the Texas Railroad Commission (and other oil states), along with the Seven Sisters in the Middle East, imposed strict production controls. Their effectiveness can be seen, using a new monthly historical oil price series developed from Bob McNally new book, Crude Volatility: The History and the Future of Boom-Bust Oil Prices (Columbia University Press, 2016)

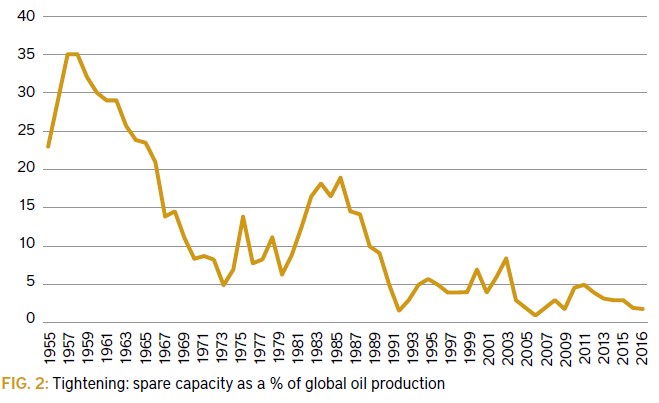

OPEC's founders tried to emulate the Texas Railroad Commission, but enjoy neither its market dominance nor cohesion. The group's high point was in the early 1980s, when Saudi Arabia last played the role of swing producer amid a massive market weakening by slashing production from 10m to 2m barrels a day. But Riyadh grew tired of surrendering market share in 1986 and crushed prices with a sudden and dramatic reversal. Since then, the kingdom has been less a swing producer and more leader in collective cuts, usually following price swoons.

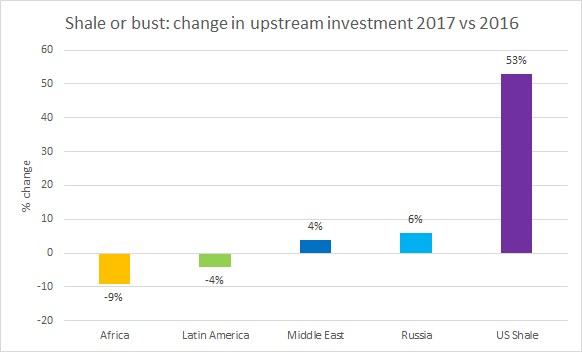

Brisk GDP growth and soaring Chinese demand 10 years ago, along with sticky non-OPEC supply, called out for a swing producer able to cap runaway prices. The quintupling of oil prices in the mid-2000s exposed Riyadh's inability to do so (Saudi Arabia, like the Texas Railroad Commission in 1972, had run out of spare capacity in peacetime.) Then, in 2014, shale's emergence required years of sustained production cuts to keep prices stable around $95/b. But Riyadh proved unwilling to play the swing producer role it abdicated in 1986.

Price slump

After crude crashed to $26/b in February 2016, Saudi Arabia changed its tune. For the better part of last year Riyadh, other Opec producers, and Russia were remarkably successful at influencing traders' perceptions by jawboning about a "freeze" in output. From January to October 2016 they talked up prices while adding a net 1.4m b/d to a glutted market. Collective cuts, mainly by Saudi Arabia after hitting a record production peak, implemented in January, may precede imminent and massive stock draws as the consensus expects, though the jury is still out and recent inventory and price data suggest grounds for skepticism.

In any event, it would be premature—at best—to view recent collective pledges as the return of an effective supply management. From oil's earliest days, crude price busts prompted terrified producers to form ad hoc, temporary and "emergency" cartels (the first was the Oil Creek Association in 1861 which lasted a few months). These emergency cartels occasionally enjoyed success, but invariably failed due to supply growth outside and cheating within OPEC.

It is possible, but unlikely, that oil supply and demand will naturally balance in the coming decades, keeping prices generally stable. More likely, the market will deal us upheaval, disruption and imbalances. Moreover, price booms and busts themselves contribute imbalances between production and consumption. Saudi Arabia remains willing to lead in collective emergency cuts following busts, but is neither able nor willing to play the genuine swing-producer role required to prevent booms and busts in the first place. Saudi oil minister Khalid al-Falih made it perfectly clear that OPEC would no longer adjust supply in response to structural imbalances in his televised dialogue with Daniel Yergin at the CERAWeek conference in March 2017. Shale is more flexible than conventional supply, but not nearly nimble enough to play the role of global supply balancer.

While shale remains a new phenomenon, the evidence so far suggests it is flexible enough to contribute to price-busting oversupply but not flexible enough to put a floor under prices. Whether shale will prove better at capping the upside when the next boom phase kicks in remains to be seen; I am skeptical. Expect temporary periods of calm prices as seen between 2010 and 2013. But buckle up for more of the wild, unexpected price swings of the sort seen over the past ten years. Welcome back to boom-bust.