Energy Security Intelligence Research

ESIR

ESG STRATEGY RISK and COMPLIANCE PLANNING AGENDA 2050

KUWAIT

Kuwait's energy sector is growing in confidence despite falling oil prices. However deep the gloom elsewhere, in Kuwait City the mood is bullish due to the fact that Kuwait enjoys the lowest per-barrel production costs in the world, and the market's weakening will expose this competitive advantage. With the average production cost per-barrel is seven dollar ($7), "analysts predicts that the last barrel of oil from this planet will be produced by Kuwait".

Kuwait's oil ministry is putting aggressive capacity growth plans for a $100 billion plan to raise production to 4 million barrels-a-day (b/d) by 2020 and expand the country's refining and petrochemicals capacity remains official policy. That means business as usual, whatever the price. This year (2016), Kuwait will deploy another 40 drilling rigs, taking the total to 120-part of a campaign to reach output capacity of 3.15 million b/d by the end-2017. In January 2015, Kuwait pumped just under 2.9 million b/d.

Moreover, there is little indication that Kuwait will support global prices. Officials talk in OPEC of Kuwait obligations to support the international oil market through quotas cuts is not fort coming, but less urgently about propping up the market. Content with fiscal breakeven prices beneath most of its OPEC peers, Kuwait whole-heartedly endorsed the Saudi-led decision in November 2014 to leave group output unchanged and let the market find its own balance. In fact, market share is the motivator for Kuwait, which is adding foreign refining capacity in key markets around the world.

In addition, Kuwait has spent recent months since March 2015 aggressively pricing crude sold into Asia market, the main target for its oil. This has contributed to a mini-pricing war in the Gulf reminding the buyers that the region's biggest producers have market share, not price, in their sights.

However, despite the public confidence, not everything is rosy in Kuwait's oil sector. Saudi Arabia's decision in October 2015 to shut down the 300,000 b/d Khafji oilfield in the Partitioned Neutral Zone (PNZ) it shares with its neighbour has instantly made Kuwait's expansion plans more difficult. The 4 million b/d target includes about 350,000 b/d from the Partitioned Neutral Zone (PNZ). So too have events at the Al-Wafra field, another Partitioned Neutral Zone (PNZ) concession, where Chevron, a long-term investor, had plans to spend $40 billion on a vast heavy-oil recovery project. Now the company seems to have been caught up in the Khafji dispute. Since 2014, Kuwait stopped issuing work permits to the super-major's employees, and output from the field has since fallen by about a fifth, to around 180,000 b/d. On top of rising costs, the political dispute now raises doubts about the US firm's Al-Wafra project, which would have accounted for a large chunk of the extra capacity needed to meet Kuwait's output target. Chevron was also negotiating with Kuwait over possible investments in the country's onshore sector too. No one will be surprised if its enthusiasm wanes.

Forthcoming challenges for Kuwait legislature

Sectors: public sector investment, private sector investment

Key Risks: economic, payment delay; non-payment

Amir Sabah al-Ahmad al-Jabir al-Sabah opened the new sitting of the National Assembly on 10 December 2016 with a speech highlighting the challenges to Kuwait’s economy. There will be significant resistance in the legislature for budgetary cuts, boosted by the wave of popular support for continued state spending despite the notable fiscal deficit. However, economic diversification projects put forward by the government will be received positively. The opposition’s inability to unite behind a single candidate in opposition to the influential speaker of parliament, Marzuk al-Ghanim, highlights its relative weakness, and the potential for the government to exploit the policy differences among different opposition groups. The government’s prominent infrastructure “mega projects” such as the al-Zur refinery project and airport expansion will stay on course.

Transition time in the Gulf

Kuwait has become the latest Gulf state to launch an ambitious plan to diversify its economy away from dependence on oil. "New Kuwait", a development strategy up to 2035, comes hard on the heels of Saudi Arabia's Vision 2030, launched in 2016.

Among the aims of New Kuwait is to boost foreign-direct investment and expand the role of the private sector. Planned mega-projects in the coming decades aim to more than triple the country's revenue, from KD13bn ($42bn) to KD35bn, in 2035.

That Gulf Cooperation Council (GCC) states need to move away from a reliance on income from hydrocarbons has been obvious for years, and the collapse of oil prices after 2014 has only reinforced that. Kuwait's latest budget, based on an oil price of $45 a barrel, projects a deficit of KD7.9bn.

The whole issue of Gulf countries having to adjust to new fiscal circumstances was one of the main themes during Petroleum Economist's GCC Strategy Forum in Kuwait in late January. For too long, delegates were told, the Gulf states believed that oil prices would remain high for ever. "I believe there's now an understanding that the joy of having $100-110/b prices is not going to come back anytime soon," said Meshal Alsamhan, of the Kuwait Institute for Scientific Research. "We have to reform our economy. We've taken a few steps—it's not enough, but at least we've started."

Last September, the Kuwaiti government raised gasoline prices, with subsidies on water and electricity to be lifted next. The measures have been bitterly criticised by members of the National Assembly and attempts are still being made to overturn them. Elsewhere in the Gulf the raising of subsidies on basic services, after many decades of artificially low tariffs, has been widely denounced by the public via social media.

Mustafa Ansari, an energy economist at Apricorp, said the GCC authorities had not done enough to convince people of the necessity of raising prices: "Energy reform is needed and is healthy. But a communications strategy is lacking. Governments should communicate with the public to explain the need to make savings and re-invest the money in the economy."

Several speakers highlighted another pressure on Gulf oil exporters: the expansion of US tight oil. "We can't live in denial anymore," Alsamhan said. "Shale is part of the energy mix. The energy mix is larger than oil, and oil is no longer dominant."

In the view of Naji Abi Aad, chief operating officer at Petroleb, an upstream firm, "the production costs of shale have decreased and there's now political will in Washington to push for more US production. Shale is backed by banks and financial institutions. They're pushing for shale."

Abi Aad went on to say that Mena oil producers should also take the development of electric vehicles seriously: "Electric cars are not a threat to oil today. But what's important is that we're seeing the first challenge to oil's niche role as the main transport fuel."

In the coming five-to-10 years, Dawood Nassif, a board director of the Bahrain Petroleum Company, told delegates, dramatic breakthroughs were likely in the cost of electric vehicles, the charging time of batteries and the distances covered. "Gasoline," he continued, "is under pressure," with refiners concluding that "diesel and jet fuel are the future."

Abi Aad said that while demand for oil was not about to disappear he was certain that the oil era had started its decline. "This is a transition period," he told the conference. "We need to be reshaping our scenarios for the future, working out how to maintain a role for oil and gas in the energy mix for as long as possible for the sake of our region."

"Fearful of American shale and electric cars, GCC states want to lessen their oil-revenue dependence."

Kuwait still drilling

Kuwait is hoping to sign more Enhanced Technical Services Agreements (Etsas) with international oil companies later this year as part of efforts to raise production capacity to 4m barrels a day by 2020, Nizar al-Adsani, head of Kuwait Petroleum Corporation (KPC) told Petroleum Economist's GCC Strategy Forum in Kuwait in late January. This involves increasing current capacity by around 1m b/d.

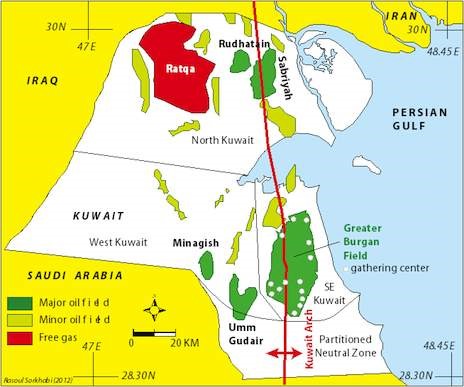

Shell and BP were awarded Estas in 2016, the former to develop heavy oil reserves in the north of the country, the latter to help extend the life of the giant Burgan field, discovered in the 1930s.

Adsani said he expected oil market volatility to "prevail in the medium term and it's legitimate to ask whether KPC is ready for the future. We recognise that it's essential to make investments now to enable Kuwait to be in a better and more flexible position in the future."

He added that the state company had prepared "a strategic plan and clear road-map for the whole oil sector" up to 2030. During the initial five-year period, beginning 2017-18, KPC would invest KD35bn ($115bn), of which 59% was allocated for specific and identified projects. Of the total expenditure, 86% would be on exploration and production, and the rest on refining and petrochemicals.

The development of heavy oil, Adsani continued, "is an integral part of our vision and plans", with investment of $6bn in the first phase of development. The aim is to reach capacity of 60,000 b/d by 2018, rising eventually to 220,000 b/d.

The involvement of IOCs in Kuwait's upstream is a sensitive issue in the emirate, with parliament and the media over the years rigorously questioning the need for outside assistance. Plans to develop the heavy oilfields in northern Kuwait have been on the table for nearly two decades. Adsani said IOCs were needed because of their "skills, knowledge and experience"; they brought "advanced new technologies never used in Kuwait".

4m b/d Kuwait's 2020 output target

The extraction of heavy oil is expensive because it requires the use of advanced enhanced oil recovery (EOR) techniques. Natural gas or diesel is burned to create the steam needed to warm the oil and allow it to flow more easily. Kuwait is now looking at a scheme being developed in Oman where solar power is used to create the steam, requiring the burning of gas or oil only during the hours of darkness, thus significantly reducing costs.

The KPC chief executive said another of the company's focuses was the petrochemicals industry. A 0.615m-b/d integrated oil refinery/petrochemical project is being developed at al-Zour in the Neutral Zone, which will process the heavy oil reserves when production begins. Another focus is the development of Jurassic free gas reserves. About 80-90% of natural gas produced in Kuwait is associated. With domestic consumption continuing to rise, Kuwait, in line with other Gulf energy producers, is forced to import liquefied natural gas to meet demand.

"We spend all our time monetising oil," said MR Raghu, managing director of Marmore Mena Intelligence, "but not natural gas. The region has huge reserves, but we are importing gas."

Producers are on track

Oil-producing states are "passing through a critical phase" as they await the impact of the Opec and non-Opec agreements to cut production, Kuwait's oil minister Issam Al-Marzouq told Petroleum Economist's annual GCC Strategy Forum in Kuwait City. But Al-Marzouq, who chairs a five-nation committee to monitor the deal, is certain that the results will be positive from the perspective of producers.

"We are confident that rebalancing in the oil markets has already started," he told delegates. "We expect a positive impact on the market by the end of the first quarter of 2017." The source of his confidence? Opec and non-Opec producers "are complying with their commitment to cut", he said. He described the deal as "a collaborative effort among producers to follow a roadmap to guarantee balance in the markets". The Kuwaiti minister said he expected oil prices to be in the $55-60-a-barrel range throughout this year.

While Kuwait has cut its production in line with the agreement it is also looking to a time when it can achieve its target of raising capacity to 4m barrels a day. For this to happen it will need to start receiving again its 250,000-b/d share from the Neutral Zone. While there are indications that Kuwait and Saudi Arabia have agreed in principle for a restart, Al-Marzouq could not predict when it would happen, saying only that he expected "a positive development" in the coming weeks. Even when a return to the fields is agreed "it will take some time before we can bring back production".

"Kuwait is plugging away in its upstream and will seek more IOC help to do so."

ONES TO WATCH

Sector: Oil and Gas

Key Risk: FDI, Environmental, Political and Economic Risks

An offshore oil spill in the Neutral Zone could complicate efforts to restart Kuwaiti-Saudi production.

Kuwait hasn't said how the spillage at Ras al-Zour occurred or how much oil lies on the northern waters of the Gulf and the nearby shore. But the development is an embarrassment for the emirate—in part because its energy sector has been dogged by accidents over recent years and partly because it occurred near the Khafji oilfield. This is run by Khafji Joint Operations, a joint venture comprising the Kuwait Gulf Oil Company (KGOC) and Aramco Gulf Operations Company on behalf of Saudi Arabia.

The spillage was also close to where Kuwait is building its massive al-Zour oil refinery, which will have capacity of 0.615m barrels a day.

Khafji used to produce 300,000 b/d, shared equally by the two partners. But Saudi Arabia in late 2014 announced that output was being shut for environmental reasons. This why the oil spillage in the area is embarrassing for Kuwait.

In the spring of 2015, output was also halted at the other field shared by the two countries in the Neutral Zone, onshore Wafra (which was producing 200,000 b/d). Its operators were KGOC and Saudi Chevron.

The reality is that the spat has less to do with the environment and more about the exercise of sovereignty in the shared area and management issues. Over recent months there've been frequent indications that the two sides have resolved their differences. In January this year, a senior Kuwaiti energy official said that an agreement in principle had been reached and he expected "a positive development" in a matter of weeks. Later in the year, Saudi Energy Minister Khalid al-Falih made a surprise visit to Kuwait, leading to speculation that a deal was ready to be signed. But pens have yet to be put to paper.

It's not clear what impact the oil spillage at Ras al-Zour will have on the dispute that's denying Kuwait and Saudi Arabia access to 250,000 b/d each of crude oil. Kuwait badly needs this production restored to enable it to maintain current output of 2.7m b/d and help it realise plans to raise capacity to 4m b/d. Saudi Arabia is in less of a hurry. Now, if it wants to delay the resumption of Neutral Zone output it can cite further environmental concerns.

The dispute over the region can't be isolated either from the current political crisis in the Gulf, where Kuwait is trying to mediate between Qatar on the one side, and Saudi Arabia, the UAE, Bahrain and Egypt on the other. The Saudis are ambivalent at the Kuwaiti stance, believing that the emirate should have thrown its weight behind the anti-Qatar coalition. The once calm waters of the Gulf are now troubled.