Energy Security Intelligence Research

ESIR

ESG STRATEGY RISK and COMPLIANCE PLANNING AGENDA 2050

Consultancy and Advisory

The complexities around finding the right investment model, and the limitation in many energy markets on investment, are slowing activity. However, at ESIR we demonstrate that there are still areas in Asia Pacific, Africa, South America that remains high as market saturation, oil glut; and economic uncertainty in mature exploration and production areas in OPEC countries. Which means that looking further afield in low production margin for development of oil and gas blocks is the answer to real opportunity.

Our consulting and advisory services recognized the combination of rising supply and lower demand in the face of growing resource technological innovation has been a key driver behind the trend towards lower oil prices. Therefore, ESIRGroup will support your company in consultancy and advisory to be at the top end of the value chain through vertical integration.

Vertical integration will enables your companies to secure new oil and gas blocks with low production margin of supply, while at the bottom end a move into processing, distribution and logistics helps to secure route to market, add value through storage and refining, and capture our data and research information through subscription and download of our metadata.

Locating the Right Exploration Block

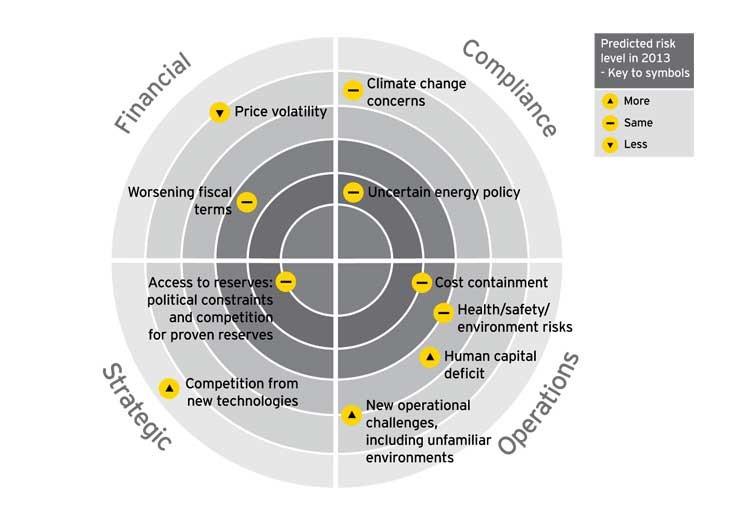

Producing oil and gas and ensuring that your cargo arrive in the right place at the right time and at the right price has become an ever more pressing issue and is driving a number of trends in the global energy market; affecting every stage of the upstream supply chain, from producers to traders through to the end refineries processor. Therefore, going to the source, taking control of sourcing is becoming harder to achieve for energy traders. However, in an environment where the best resources are often remote and hard to access because of war, economic and political instability, oil companies face the challenge of whether to drill or apply force majeure. In ESIRGroup, we don't believe in a perfect world. Therefore, we will conduct risk-based strategy for overcoming dealing with uncertainty, conduct thorough due diligence that would uncover every compliance, security of your infrastructure, market insights, protection of your investment, regulatory challenges; and mitigating against the unforeseen circumstances for your company to grow. What's harder for energy companies is the fact that, when doing oil and gas production in emerging markets is the ever-changing and often contradictory legal framework, conflict and wars, safety of expatriates, and political situation.

Overcoming these hurdles is our priority. Despite the growing complexity of energy companies, producing oil and gas in unstable countries, many oil majors business leaders admit they do not pay enough attention to these factors in early stages of energy exploration and production. As companies enter a period of low commodity price, and a renewed focus on growth, however, it's crucial business leaders gain a greater consulting and advisory services in understanding of these issues and develop strategies to manage the risk. Otherwise they may find it difficult to achieve the desired value and objectives of their business transformations. ESIR Group is here to help you get the best advise.

COUNTRY RISK PROFILES IN SUB-SAHARAN AFRICA

This report was generated based on an expert consulting and advisory knowledge supported by primary data for foreign investors and IOCs who wishes to operate in emerging market in the energy and mining industry sector. The aim of this report is to help industry investors in various countries and context conditions, to be aware of policies, security risks, regulatory frameworks and industrial strategies to maximize the benefits of their operations in solid mineral mining, oil and gas development that could promise while reducing the associated risks.

In this report, ESIR examines strategies for overcoming compliance risk and regulatory challenges in cross-border mining codes and the risks and benefits of new blocks on offer to guide the deliberations of acreage operators, investors and stakeholders involved in companies’ operation in solid minerals mining, oil and gas sector. This report is based in part on ESIR’s integrated approach to risk governance and investment compliance deficits, and in part on the insights that will mitigate against force majeure in their operations.

Moreover, the world’s reliance on solid minerals is still very heavy, and security of supply is a key issue for both governments and businesses. However, recent trends in Africa-clearly identified compliance standards in areas such as tax, due diligence, corruption risks, employment and regulatory matters

This far-reaching, and inter-link trends place the mining of solid mineral, oil and gas sector at the centre of the global political and economic stage. It’s hope that analysing how business models in these sectors are changing to meet business transformation in an increasingly complex world with rising demand amid commodity price slump and national interest/geo-politics is a vital element in how the global economy will evolve in dealing with uncertainty over mining licences in the coming decades.

We hope that this report—and the perspectives it offers—will add to the business insight. Further information on the report, and additional analysis, can be obtained from our website commodity section.

Moreover, the World Bank Guidelines

on the treatment of foreign direct investment provide that, in the absence of

an agreed method, foreign investors may be able to seek redress in the event

their assets are nationalized, pursuant to bilateral and multilateral

investment treaties which preclude nationalization in the absence of prompt,

adequate and effective compensation

| 0,COUNTRY RISK PROFILES IN SUB-SAHARAN AFRICA |

1. INTRODUCTION 2. Increased Royalty Rates and Taxes on Companies Operating in the Mining Industry. 3. Minimum State Shareholding rights. 4. Minimum Requirements for Local Sourcing of Goods, Labour and Services. 5. Factors Influencing Resource Nationalism. 6. Contractual Regimes and Government involvement.

7. How can Companies Protect their Investment? 8. Long-term Mitigation Strategies. 9. Reactive Solutions. 10.Conclusion 11.References ONES TO WATCH APPENDIX: Q1. A review of ICSID cases in Sub-Saharan Africa identify three key issues Q2. Zambia State Electricity Utility USD850 Million Loan, five key indicators to monitor Q3. Security and Intelligence Briefing for a Logistics company: Beni, North Kiva, DRC and Dar es Salaam Q4. Scenario A: The CEMAC countries decide to abandon the CFA franc’s fixed Euro peg Q4. Scenario B: Prime Minister Abiy Ahmed is forcibly removed from power in Ethiopia

|

"......the mere fact that there are so many variables at play should give trading oil and gas companies, with their greater appetite for risk and complexity, confidence that they will enjoy a key role in shaping the future of the global energy market."

| Entering New Markets and Dealing with Uncertainty in Oil and Gas Industry | Storage of Oil Special Report 2017 |

Investment Protection Advisory in Oil and Gas

"Since we live in an uncertain world in the energy sector, where the risk landscape for international investors in energy industry has seldom been as challenging. Therefore, political and economic risk factor such as Brexit, import restrictions in the Middle East, the US-China-EU "trade war", and the high-profile use of financial sanctions are the daily folder of international trade. Managing investment risk in an uncertain world is the answer.

-Executive Summary

-Introduction

-Traditional Investor Protection

-The Changing Landscape

-European Intervention

-Treaty Termination

-Protectionist Policies

-Is Restructuring an Option?

-What Next?

Storage of Oil Special Report 2017

Trading in oil and gas/LNG in a volatile market is a high risk for energy investors. Since oil prices have found a floor of about $50 a barrel is still short of a major geopolitical shock, a price surge is not on its way, except you have excess storage facility to mitigate against price volatility. To gain a real sustainable trading platform, every energy company need a storage of some kind waiting for a price surge to absorbed a price shock.

Even when some insiders were calling for real and deep cuts to supply, storage is the only weapon to avoid shock and awe. Without adequate storage as a trader, between now and then bearish momentum could build as refineries enter maintenance, US inventory holders liquidate to avoid end-year taxes on shocks, and macro-economic worries is already resurfacing, not least the US Federal Reserve’s impending interest-rate rise or a new banking crisis loaming. It’s estimated that global oil-demand growth is weakening-the most recent International Energy Agency assessment for Q1 2017 saw a rise of just 0.8m b/d.

Moreover, when managing supply and hedging around a 200,000-barrel-a-day, refinery which had crude storage of close to 2m barrels; or a company that rarely kept storage completely full but the contango was too large to have empty space, and so a plan can be created to secure a long-term rateable supply of crude. As soon as company build adequate storage, it can be confident enough of securing the supply. A company can buy front-month futures contracts and sold those it had down the curve to lock in the contango. That will enable them to lower the cost of their inventory every month.

For example, if a cargo is priced to determine the flat price for payment, this type of structure is referred to as a physical published price index when the cargo was five days out of port on a three-day average. But when the three-day pricing arrived, it must sell for about 200 front-month crude futures contracts on each of the three days for a total of 600 contracts. This would cancel out the original long position they had and to begin to realise a contango profit. For instance, if crude contango more than $1.50 per barrel monthly, this will enable trading to increase refining margins each month. Thanks to the storage capability, this put them at a competitive advantage to those that didn't, all while generating excess returns.

The bottom line is that: how much cost reduction is sustainable without adequate storage facility? While technology and drilling improvements have clearly helped; companies are now getting much oil output for each dollar spent. Drillers are now able to sink multiple wells from a single location, which helps cut costs and time. The wells themselves are also better engineered now than they were a couple of years ago. They’re drilled longer, which helps tap into more of the shale seam with each well. Companies are also pumping more and more sand and proppant into the wells, which unleashes more of oil and gas when the well starts producing, meaning operators recover their costs quicker and, they hope, ultimately recover more from each well. These sorts of engineering and technical advances will continue to deliver benefits no matter what the oil price. But to reap these benefits and cut cost is the ability of companies to create adequate storage facility to mitigate against price volatility.

In this report, ESIR examines strategies when managing supply and hedging around oil storage. This report is based in part on ESIR's integrated approach to risk governance and security deficits, and in parts on the insights that will mitigate against price volatility in the oil and gas trading for company's operations. This 25 pages report includes the following strategies:

- Capacity available

- Tanks, gluts, contangos and markets fundamentals

- The search for storage

- China's strategic petroleum reserves (SPR): cheap oil

- Chasing Demand-Buyer's market

- Alternative storage system-working on the railroad

- Consulting and advisory for investors, and

- Appendix

We hoped that this report and perspectives it offers will add to your business insight.

The great LNG market showdown-What's the Future for the Gas Market?

While OPEC oil cut may not apply exactly to the global gas glut, suppliers have a message for buyers: the good times are coming to an end.

"With supply short-term being abundant it's very understandable that buyers don't want to look beyond, but they need to look over the crest of the hill," Peter Coleman, Woodside Energy's chief executive, told the 29th Gastech conference in Chiba Prefecture, on Tokyo's eastern outskirts. "And it's clear that a supply shortage looms unless investment decisions are taken soon."

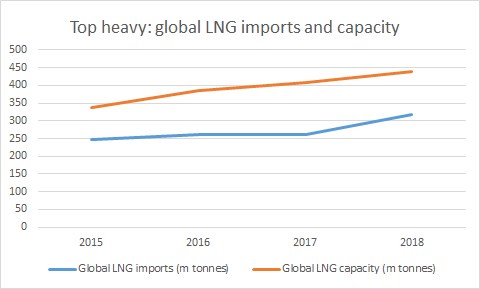

Such a warning may seem laughable to liquefied natural gas buyers enjoying a market characterised by sheer abundance. This year global liquefaction capacity is expected to reach 408m tonnes, says Energy Aspects, a consultancy—a 70m-tonne increase from 2015. But LNG imports (the closest proxy for demand) will be just 261.2m tonnes, a rise of just 15m from 2015.

Much of this new capacity will come from Australia, which could overtake Qatar's 77m tonnes a year of supply to be become the world's largest exporter. A few years behind will come the US—its capacity will more than double in 2017, to 25m t/y, and reach 65m t/y by the end of the decade.

Inevitably, LNG prices have been under pressure.

LNG landed in Japan, for example, will sell for about $5.50 per million British thermal units this year (2017), reckons Energy Aspects, before dropping to around $4.20/m Btu in 2018. Just two years ago, an exporter could expect to sell a cargo in Asia for almost $16/m Btu.

But the cure for low prices, say producers, is low prices. The weak market now has pushed capital investment in costly new projects off a precipice. That means one thing, says hopeful exporters—an inevitable supply dearth that will force prices higher.

"The current conditions are not favourable to major greenfield development according to analysts, citing a hosts of risks discouraging investment, from geopolitics and policy, to climate change measures, taxation, changes in contract terms and rising funding costs. "The result is that only small volumes have gone to final investment decision (FID) in 2016. And 2017 looks set to be another challenging year."

That, say LNG boosters, is exactly where the opportunity is. Charif Souki, the former head of US LNG exporter Cheniere Energy who is now running Tellurian Investments, which wants to build more American export capacity, says the dearth of new projects means the global market will be soon be short 100m t/y of capacity needed to meet demand. It's the basis of his bullish take on the market.

Buyer power

LNG buyers aren't convinced. They think the fundamentals are in their favour - and are glad to see the back of contract terms that used to favour exporters, like decades-long contracts pegged to oil prices (often with destination clauses preventing them from selling on excess gas). Producers need to be more flexible now that power lies with a new breed of importer, they say.

"Particularly conservative sellers say we need long-term contracts and a lack of investment will create a shortage of supply and buyers need to be aware of that. But it's the market that will drive the changes," Sam Muraki, executive advisor at Tokyo Gas, tells Petroleum Economist. "Probably they are thinking about traditional buyers, like utility companies. But for new markets like southeast Asia, the Middle East, India or in LNG bunkering—who is going to take long-term contracts?" His advice for exporters? "They have to change their mindset."

Not that Muraki is gloomy about LNG. He expects the global trade in seaborne gas to exceed that by pipeline by 2040—but alongside the shift will come a slow but steady move away from long-term oil-indexed contracts to spot-trading models. Asia will be at the forefront of the new market dynamics.

For now, long-term LNG sales contracts—which today comprise around two-thirds of the trade—will be the mainstay. But over time, the power of the long-term deal will wane as more and more deals are done on a spot basis.

"The large suppliers with a large portfolio, like Shell and ExxonMobil—they will be more flexible. But Woodside? They don't have a portfolio," Muraki said. "They only have projects in Australia and very expensive construction costs. Woodside doesn't represent all the sellers (in the market)."

Therefore, buyers are clubbing together to reinforce their power, too. In March 2017, South Korea's kogas, Japan's Jera and China's Cnooc formed an alliance to buy LNG and pressure producers to restrictive contract terms, such as destination clauses. The group has some clout, buying about a third of the world's LNG.

Regional demand surge

One positive for exporters is that the market for LNG is widening. Japan and South Korea once accounted for about 70% of global LNG demand, but buyers in India, China, Bangladesh, Vietnam and the Philippines offer new—often more dynamic—growth centres. Helping them along is the rising uptake of floating, storage and regasification units (FSRUs). "Regasification technology has allowed new countries to enter the market and imports into countries using FSRUs is growing."

Between 2012 and 2016, LNG demand from FSRUs trebled to 30m t/y. Indonesia, Pakistan, Argentina, Brazil, Egypt and Jordan are among the countries turning to the new floating technology. "FSRUs are simply a game changer for our industry. Emerging markets now account for 5% of global LNG demand and that's expected to grow to around 27% by 2025 according to the Petroleum economist.

And with that new source of demand in mind, it has some advice for importers. "It's time for buyers to engage again in recognition that this time of abundance will not last. Those who move first will get access to the most promising projects offering the most eligible supplies. The changes occurring in the market now mean there will be competition for those supplies very soon."

That might depend on Japan. Its LNG demand fell by around 2% last year, to 83m tonnes, as some nuclear capacity coming back online. Around 12 of the country's nuclear plants have applied to restart, and if they get the go-ahead LNG consumption will fall by 70m t/y by 2020, predicts Wood Mackenzie, a consultancy.

So the market may need to digest a lot of LNG before supply and demand start tightening. "Japan alone consumes more LNG than the entire Atlantic basin," notes Kerry Anne Shanks, an analyst at Wood Mackenzie. "If its nuclear restart programme is successful we may see a situation where you haven't got this reliable customer, which could create some price volatility".

Others are more bullish. Tokyo Gas's Muraki says political opposition to nuclear power will hinder the restart, allowing gas to hold onto its market share. He adds: "There is a new type of buyer coming into Japan's fully liberalised gas market: large commercial, industrial customers who can come to the market and can directly buy LNG." They provide a new, overlooked, source of competition for gas—and they'll help drive the trend toward spot trading and greater liquidity in Asia's LNG market.

Asia's eyes on the Atlantic

And, in the mood for flexible and cheap gas, these new buyers are looking to North America for their cargoes.

"The new president of the US is a big disrupter but his administration will promote exploration and exports of gas and oil, as well as infrastructure development," says Muraki. "They have some pipeline bottlenecks but if they can build some (new pipelines) between the northeast and the Gulf then transportation costs will be reduced and US natural gas will become even more cost competitive—as long as they have reserves."

For Muraki, the US' growing LNG exports offers buyers the chance to help develop a new, highly fungible and transparent industry. And he gives short shrift to producers like Woodside, whose boss Coleman says today's weak LNG prices offer no incentive to invest. US producers seem ready to invest, Muraki points out. "Sellers have to innovate to reduce the cost of projects." "The Qatari model"—long-term contracts for high-priced gas—is also no longer relevant," he says. Only if Henry Hub prices reached $7-8/m Btu, or more than double their level now, would the shine come off the idea of US LNG imports in Asia.

And that's not going to happen, says Tellurian's Souki, who thinks US gas will sell for $3/m Btu for the next two decades. "At the moment, in the northeast US there is 20bn cubic feet per day of production that is mostly constrained by infrastructure and that is available at the wellhead at $1/m Btu or less."

Souki told the Gastech conference he would consider offering LNG from Tellurian's proposed Driftwood project on a five-year fixed price deal at around $7-8/m Btu. The first train from the project, which has not yet been approved, is scheduled to come online in 2022.

Once operational in 2025, the five-train project would have capacity to export 26m t/y of LNG from a terminal on the Calcasieu River, south of Lake Charles in Louisiana.

By then, the dust might have settled on today's collision between buyers and sellers. "At the moment we don't have a business model in the industry because we can't get anyone to agree," Souki says. "If buyers are counting on the spot market, well we haven't invented the business model yet."

And he's optimistic that the glut will soon pass. "These very low prices are stimulating demand. You can be oversupplied on a 12-month basis but that doesn't mean that in winter when everyone needs gas that you're actually oversupplied," Souki says. "I'm reasonably certain that all the excess gas will have been absorbed by the end of the decade and we'll be in another price crisis and all the buyers will be complaining."

Japan isn't the only big player that might have a say in that.

On 3 April 2017, Qatar, still the world's biggest LNG exporter, said it would end its self-imposed moratorium on development of the North Field. The move—a surprise to many in the market—carried a few messages. One was that Qatar would not stand by while Iran developed its own gas business across the maritime border, at South Pars (the Iranian name for the North Field it shares with Qatar). Another signal was sent in the direction of Australia, and suggested Qatar isn't ready yet to surrender its title as the world's pre-eminent LNG exporter.

But the bigger meaning of the North Field reopening will be understood across the LNG industry. If a dearth in supply is to emerge in the coming years, Qatar will be ready to help fill it, and fight for its share of the market. And in a world of abundant supply, the low-cost producer will be king.

In Conclusion: "Sellers say a supply crunch is looming. Buyers say suppliers are out of touch with the changing times".